What is a Members' Voluntary Liquidation?

A solvent liquidation is known as a Members’ Voluntary Liquidation (MVL). Here a Liquidator is appointed by the shareholders if the Company’s assets are sufficient to settle all its debts including interest within a period not exceeding 12 months.

This means that there will be no claims against the company, it being able to pay all its debts, the obligations to all secured creditors and unsecured creditors being met in full.

Need help?

If your business is facing insolvency, the sooner you contact us, the more we can help.

When is an MVL used?

An MVL is typically used when a company (or a subsidiary company which is part of a group of companies) has come to the end of its useful life, even though it is a going-concern. This might be because the company directors and shareholders wish to retire, for example, or because the shareholders/directors no longer wish to work with each other.

MVLs may also be used for purposes of reorganisation, for tax reasons or in the case of owner-managed businesses to enable the shareholders to realise their interest in the company when they do not have succession plans.

Are MVLs eligible for Business Asset Disposal Relief?

This has been an attractive and popular method of reducing the amount of Capital Gains Tax (CGT) that must be paid on the sale of a solvent company and/or its assets, from the standard rate to a 10% rate. It can save business owners many £000s. However, THE CGT rate is increasing from 6th April 2025 to 14%, so talk to us for more details.

How quickly can fund distribution start?

If you appoint us to liquidate your solvent Company, we confirm that we can distribute the majority of the funds and assets of the company held to you more or less immediately upon appointment after signing a Deed of Indemnity and distribute the remaining funds when we have concluded that all other debts have been paid in full. We have successfully completed hundreds of Members Voluntary Liquidations.

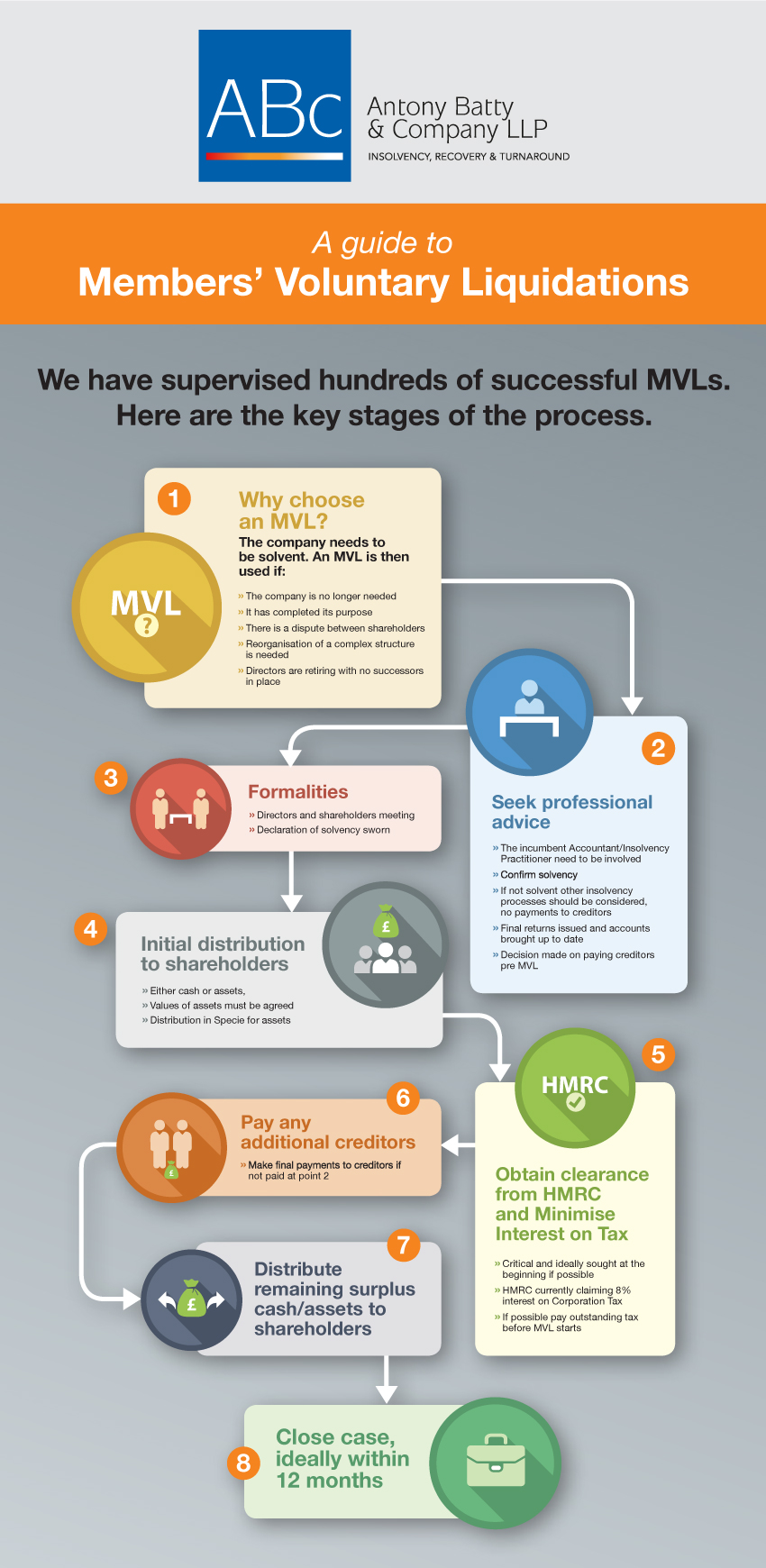

A quick guide to the MVL process

via Google Reviews

How much will an MVL cost? Our fixed fee service

For a straightforward MVL, assuming all trade debts are settled prior to the our appointment as Liquidator (excluding tax liabilities) and there are no assets to realise other than cash at bank, our quotes are normally fixed fees, plus expenses (comprising insurance and statutory advertising) and VAT, depending on the complexity of the Liquidation.

Members' Voluntary Liquidations FAQs

An MVL requires a Declaration of Solvency, which is a statement by the directors that says there are sufficient realisable assets for the company to pay off:

- All of its liabilities

- The cost of the liquidation process, and

- Any statutory interest on all creditor balances

It is a legally binding document that we will work with you to prepare following detailed discussions with you.

If the figures do not provide evidence to support a Declaration of Solvency, we would recommend an alternative procedure. This would normally be a Creditors Voluntary Liquidation.

An MVL can only be used to close down a solvent company in which all of the creditors can be paid within 12 months of the formal start of the process. The directors need to totally sure of this solvency because if, after the start of the process, the liquidator (normally an Insolvency Practitioner) discovers that the reality is that the company is insolvent, then they are obliged to convert the MVL into a Creditors Voluntary Liquidation.

This can and does happen. Directors might think that their balance sheet is healthy, but it is very important for directors to also consider contingent creditors when deciding on the solvency if a company. These include: termination charges on leases, any guarantees that have provided, pension liabilities and potential redundancy costs on staff terminations. Liabilities such as these can turn a healthy balance sheet into an insolvent one.

An MVL is a tax efficient process used to distribute funds of a solvent Company which is no longer trading via capital gains tax (CGT) rather than as dividends.

An MVL is a method, if particular requirements are met, allowing reserves derived from profits to be potentially treated as capital and under the Business Asset Disposal Relief scheme a personal tax rate of as little as 10% can be enjoyed.

We would always recommend tax advice be taken when considering an MVL and we are happy to work with your existing advisers or introduce suitable alternative advisers should you need this.

See our blog on Corporation Tax Changes