HMRC, Restaurants, VAT and Insolvency Practitioners

HMRC Gets Tough on ‘Tax Avoidance’ by Restaurants. £160,000 VAT owed and £50,000 fine for Kebab Shop.

In this case study, a restaurant went into liquidation due to this unaffordable tax liability imposed by HMRC for alleged tax avoidance. We could have helped if called in soon enough.

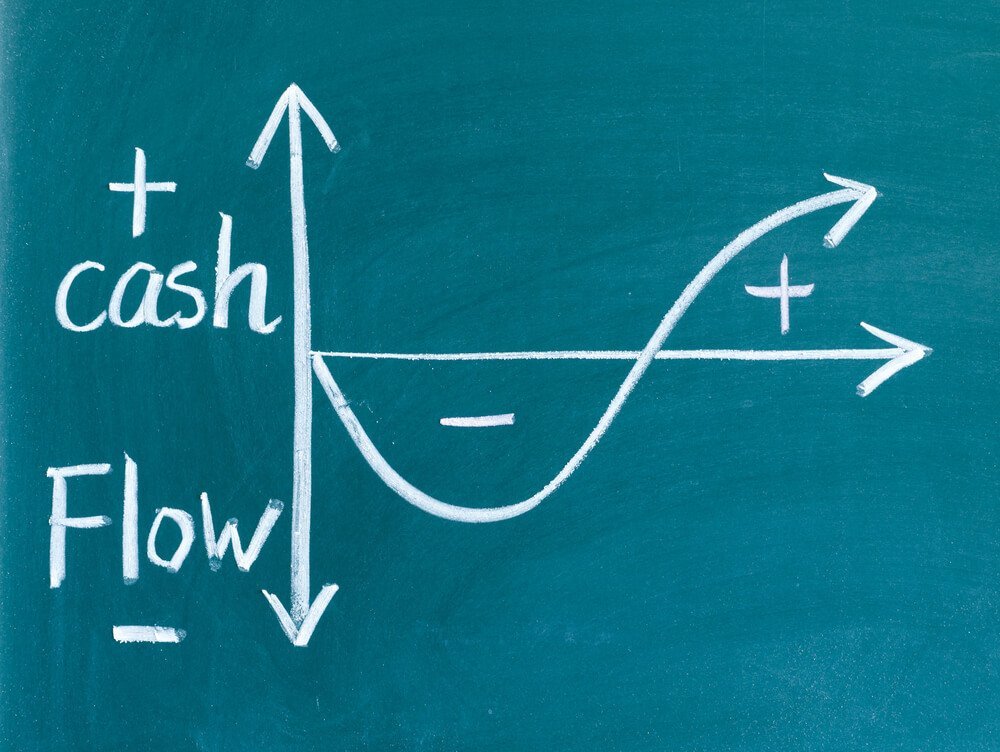

The Importance of Cash Flow. Insolvency Practitioners can Help

Cash Flow Monitoring is Vital. How Good is Your Company’s?

As the new year of 2018 dawns, it seems a good time to reiterate that cash flow is a pivotal tool that is necessary for established business and even more so for new start-ups.