What are the Duties of Directors and their responsibilities?

The Insolvency Act 1986 and the Company Directors Disqualification Act 1986 consolidated legislation on the responsibilities and duties of directors in relation to insolvent Companies. It also introduced the new concept of wrongful trading which can potentially attract personal liability to directors. Directors’ responsibilities are onerous and they increase as the Company faces insolvency.

Often when a Company becomes insolvent, if the Insolvency Service has reason to believe that the insolvency was caused by a director(s) not carrying out his/her responsibilities or obligations correctly, then they will investigate. The outcome of such an investigation can lead to director disqualification.

Need help?

If your business is facing insolvency, the sooner you contact us, the more we can help.

We explain the Duties of Directors in this video

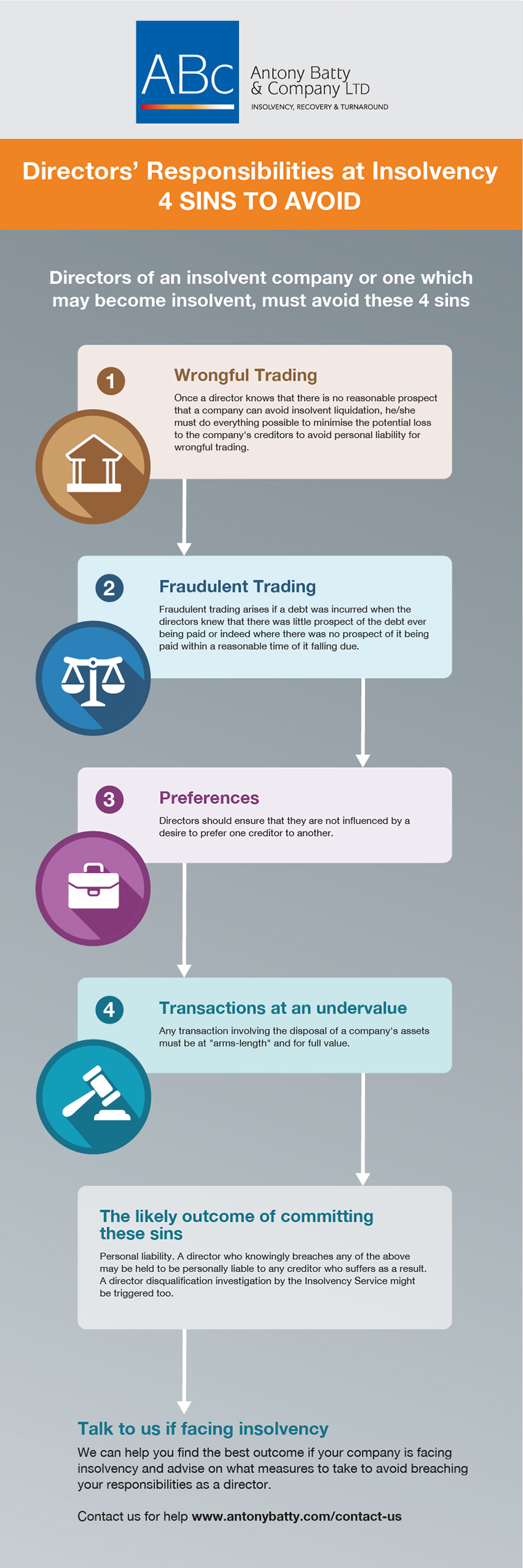

The Duties of Directors: 4 Sins Directors of Insolvent Companies must avoid

A company is legally insolvent if does not have assets to cover its liabilities or it is unable to pay its debts as they fall due. Directors of an Insolvent Company, or one which may become insolvent, must avoid the “four sins” as shown in the infographic below. They are key duties of directors that must be followed in order to avoid the threat of director disqualification or misfeasance.

Directors' Duties FAQs

A director is an individual or a corporate body who is properly appointed and registered as a director. The term also includes a “shadow director.” This is any person, which may include a corporate body, on whose instruction or directions the directors are accustomed to act, as well as those persons who hold themselves out as directors although not formally authorised to act as a director.

At all times, a reasonable standard of skill and care is owed to the Company. Simply put the directors of a company must always act in good faith when dealing with the affairs of the company. This includes its shareholders and employees. If there is any doubt over the Company’s solvency, a similar duty is owed to the company’s creditors.

Particular care needs to be exercised if you are the director of one or more Companies in a group situation. There is a need to ensure that transactions between Companies are in the interests of both of them and that any conflicts of interest are properly disclosed.

The Companies Act legislation sets out the responsibilities and duties of directors. Any director is in effect a “trustee” of the Company’s assets in fulfilling his/her responsibility.

A Company is deemed to be insolvent when the Company is either unable to pay its business debts as they fall due or where the value of the assets of the company are less than the amount of its liabilities including contingent and prospective liabilities.

Please see our blog on Personal Guarantees

Take professional advice from an Insolvency Practitioner to advise you of the various alternative courses of action. These include not only the procedures available to deal with a corporate insolvency (Administration, Liquidation or Company Voluntary Arrangements), but also what to do if you are threatened with Director Disqualification as a result of an Insolvency Service Investigation.

Director Disqualification can be for a maximum of 15 years. It is a severe punishment and means that the disqualified director cannot, without the permission of The Court:

- Act as a director of a Company

- Take part, directly or indirectly, in the promotion, formation or management of a Company or limited liability partnership.

- Be a receiver of a company’s property.

via Google Reviews

What are the duties of a director when a company is insolvent?

When a company finds itself in financial distress, it becomes even more important for all directors and officers to apply due diligence when carrying out their duties. Failure to take this level of reasonable care could have dramatic effects, a director potentially finding themselves facing action from the Insolvency Service if there is evidence of negligence.

For help and advice on insolvency and the possible issues regarding the duties and responsibilities of directors, including director disqualification, the sooner you get in touch, the more we can help. The initial discussion is free.

Antony Batty & Company’s insolvency practitioners have been advising companies on all matters relating to insolvency and restructuring since 1997, helping them to get into a position where they can meet the needs of unsecured and secured creditors alike.

Often this is achieved through some form of debt-restructuring, if we are called in quickly enough, whilst of course acting in the best interests of the company and to the benefit of creditors. Our insolvency professionals are ready and waiting to help if your business faces the prospect of insolvency.