When is a Company Administration procedure used? How can one help my company?

A Company Administration is used when at least part of an insolvent business can be sold or salvaged

Company Administration is an insolvency procedure designed to rescue a company (separate from a Company Voluntary Arrangement) being used if it is considered that all or part of an insolvent business can be sold or salvaged as a viable going concern. An Administrator is appointed to control the business of an insolvent Company and ensure that the proposals put to the creditors are properly formulated and implemented.

Need help?

If your business is facing insolvency, the sooner you contact us, the more we can help.

What is a Company Administration?

Hugh Jesseman, Licensed Insolvency Practitioner explains about Company Administrations

via Google Reviews

We are experienced in Company Administration

The first matter that has to be dealt with is to appoint an Administrator. Only Licensed Insolvency Practitioners can be appointed as Administrators. When appointed as a Company Administrator we will effectively take charge of the running of the business. During an Administration, protection from creditors’ claims means there is time to develop a plan for the company’s future.

We are experienced in Company Administration and as part of our role we speak to the business’s bankers, HMRC and major suppliers to explain our plans in more detail in order to gain their support. This often requires delicate and confidential negotiations to achieve the best possible outcome, and we have experts that are very experienced in doing so.

What is a Pre Pack Administration? It is essentially the same thing as an Administration. The difference between the two procedures is that with a pre-pack there is already a purchaser for the business and that all the terms of sale have been agreed in advance of the appointment of the Administrator. This means that the sale of any company assets can be completed as soon as an Administrator has been appointed.

What issues need to be considered before an Administrator is appointed?

Once the decision has been made to opt for administration, the company directors can choose to appoint an Administrator who will then be responsible for the affairs of the company. Often several Administrators are considered before the appointment is made. However, holders of floating charges (often a bank or banks) can force the appointment of an Administrator if the company has not upheld the conditions of any debenture agreement.

Issues that need to be considered prior to the appointment include:

- Is it possible to continue to trade the business? In other words will it be able to pay its debts and meet its obligations in the future?

- Is a pre-pack administration a possible option? If yes, consideration needs to be given to referring the matter to the pre-pack panel.

- Could it be licenced to a 3rd party?

- Are there any existing Insolvency Proceedings in place, such as a winding up petition or order?

- Is closing the business down the only viable option, all debt management and debt solutions having been considered?

What are the benefits of Administration in relation to creditors’ rights?

Administration protects a company from creditor or legal action whilst a strategy which benefits all stakeholders, in particular creditors, is formulated and proposed to creditors (often at a ‘creditors meeting’).

The Enterprise Act 2002 introduced an out of Court mechanism for the appointment of Administrators. This has made the process more mainstream by becoming streamlined and as a consequence, less expensive to implement.

The Administration procedure can significantly increase realisations for the benefit of creditors. We have also used the procedure to rescue a number of companies which have subsequently successfully exited Administration.

What happens during an Administration?

- Creditors cannot take any legal action against the company, including claims, without permission of the court. This gives the company time to formulate a plan to address its debts.

- This removal of any threat from creditors reduces the possibility of any company directors indulging in wrongful trading, which can lead to directors becoming personally liable.

- Finally, a company that has entered into Administration can protect itself from being place into compulsory liquidation if a Winding Up Petition has been issued against it.

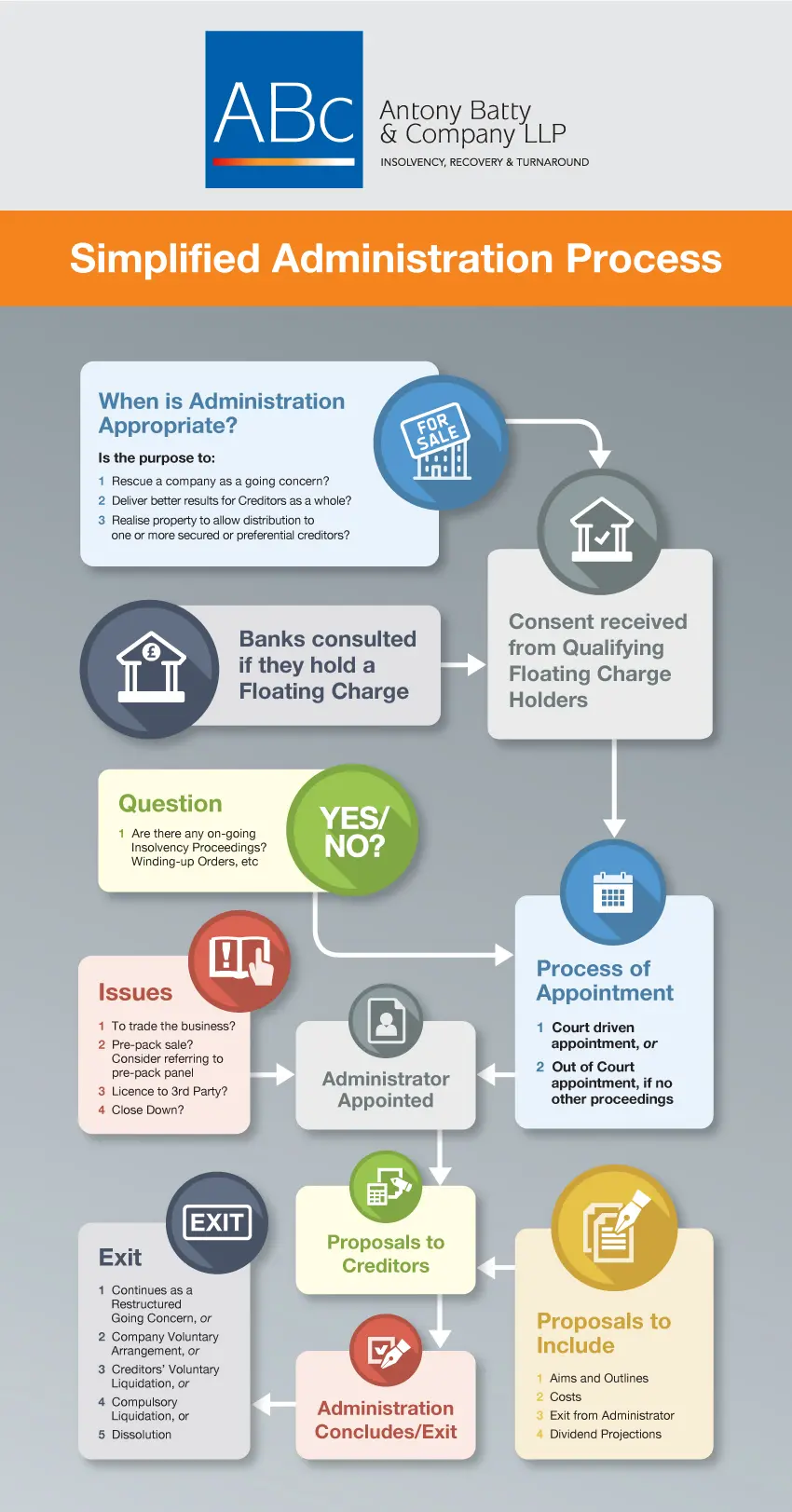

The Company Administration Process – Simplified

The Company Administration process is usually seen as quite complex, and it often is, although sometimes it can be fairly quick and straightforward. It all depends on the specific circumstances of the company involved. However, the main steps in the process are the same – it’s how the administrator deals with these steps that really counts.

We have put together this infographic which simplifies the process. Full details of the Administration Process can be found in the insolvency legislation that makes up the Companies Act, 2006.

Compulsory Liquidation FAQs

An order made in a county court to arrange and administer the payment of debts by an individual; or an order made by a court in respect of a company that appoints an administrator to take control of the company. A company can also be put into administration if a floating charge holder, or the directors or the company itself file the requisite notice at court. An Out of Court Administration process was introduced by the Enterprise Act 2002.

The title of an Insolvency Practitioner (IP) appointed by the holder of a debenture that is secured by a floating charge that covers the whole or substantially the whole of the company’s assets. The IP’s task is to realise those assets on behalf of the debenture holder.

The process where an IP is appointed by a debenture holder (lender) to realise a company’s assets and pay preferential creditors and the debenture holder’s debt. The right of a debenture holder to appoint an administrative receiver has been restricted by the Enterprise Act 2002.

An IP appointed by the court under an administration order or by a floating charge holder or by the company or its directors filing the requisite notice at court.